February 2026 is an important month for millions of Americans who depend on Social Security retirement and Social Security Disability Insurance benefits. For many households, these monthly payments are the main source of income used to pay for housing, food, utilities, and medical expenses. Knowing when your payment will arrive and understanding how it is calculated can help you plan your budget with more confidence.

How Payment Dates Are Scheduled

Social Security payments are sent out using a structured system. Not everyone receives their money on the same day. The date depends on when you first started receiving benefits and your birth date.

People who began collecting benefits before May 1997 are usually paid near the beginning of each month. Those who started after May 1997 follow a birth-date schedule. Individuals born early in the month are paid earlier in the cycle, while those born later receive payment later in the month. This pattern remains the same in February 2026.

SSDI payments generally follow the same birth-date schedule. However, people who receive both SSDI and Supplemental Security Income may notice different timing because SSI is typically paid at the start of the month.

Cost-of-Living Adjustment in 2026

Each year, benefits are updated through a Cost-of-Living Adjustment, often called COLA. This adjustment is meant to help benefits keep up with rising prices. The updated amount begins in January, so February 2026 payments already reflect the new rate.

Most beneficiaries will see a higher gross benefit compared to last year. Since the increase is based on a percentage, people with larger base benefits will see a bigger dollar increase. However, the amount that actually appears in your bank account may be slightly different because of deductions.

Medicare and Other Deductions

Many recipients are enrolled in Medicare Part B. In most cases, the monthly premium is automatically deducted before the Social Security payment is deposited. If Medicare premiums increase, the deduction may rise as well. This can reduce the final amount deposited, even though the overall benefit has increased due to COLA. Checking your annual benefit statement can help explain any differences.

No Confirmed Stimulus Payment

There has been discussion online about possible federal stimulus payments in 2026. At this time, there is no confirmed nationwide stimulus payment scheduled for February. Any new federal program would require official approval and a public announcement. It is important to rely only on verified government sources.

Staying Informed and Safe

The best way to confirm your payment details is through your official Social Security online account. Direct deposit remains the fastest and safest method to receive benefits. Be cautious of scams asking for personal information, especially around payment dates.

यह भी पढ़े:

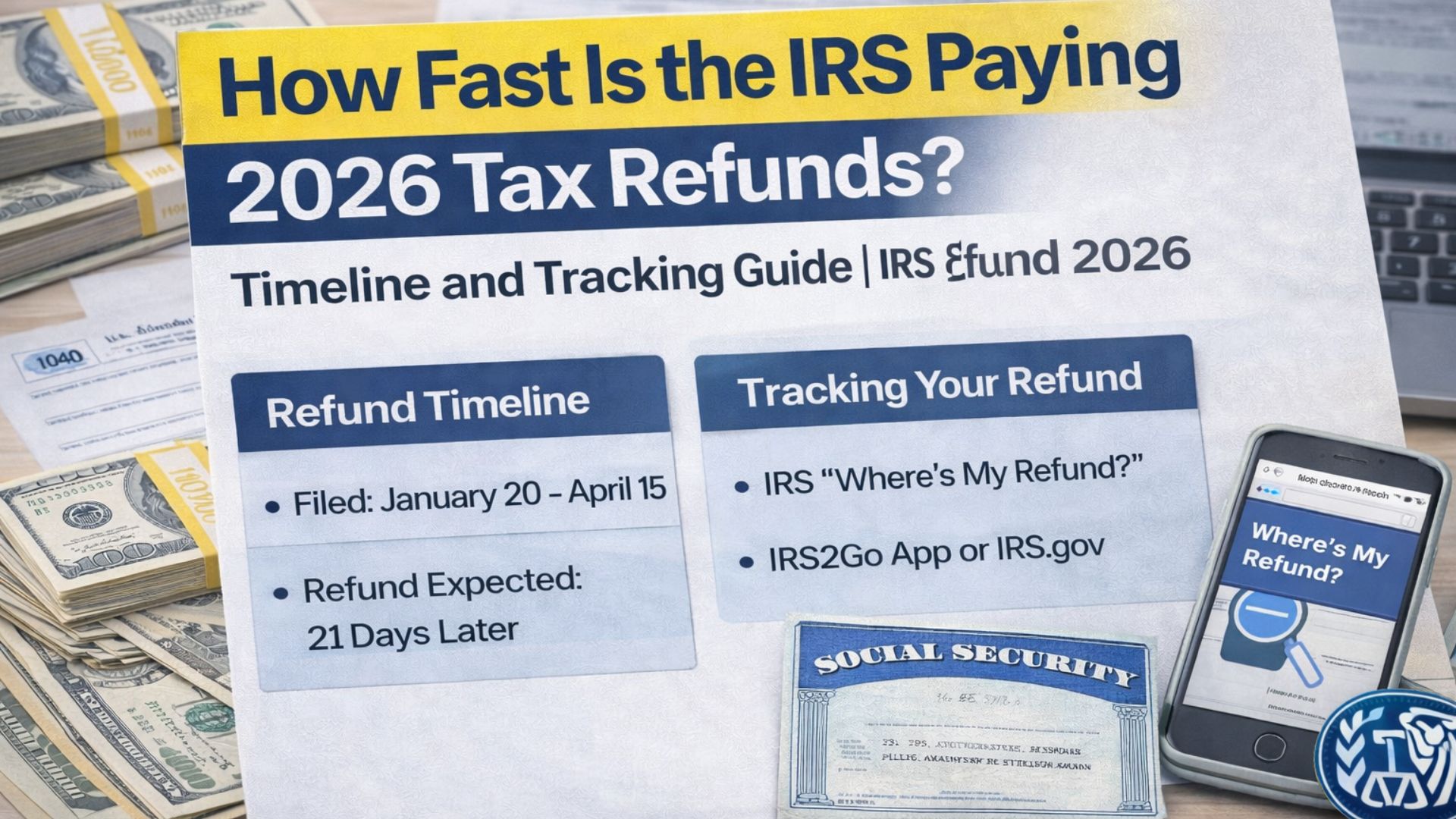

IRS Tax Refund 2026 Guide: Processing Timelines, Key Rules, and What Taxpayers Should Expect

IRS Tax Refund 2026 Guide: Processing Timelines, Key Rules, and What Taxpayers Should Expect

Disclaimer: This article is for general informational purposes only and does not provide financial, legal, or benefits advice. Payment dates, amounts, and deductions depend on individual eligibility and official government policies. Always verify details through official Social Security resources.