As 2026 begins, many families across the United States are paying close attention to reports of a one-time $2,000 direct deposit from the Internal Revenue Service. With rent, groceries, utilities, and winter heating bills remaining high, this payment is described as short-term financial support to help households manage essential expenses at the start of the year.

The January 2026 $2,000 payment is presented as a special relief measure. It is not a traditional tax refund and does not depend on overpaid taxes. It is also not a loan, meaning eligible recipients would not need to repay it. The purpose of the payment is to provide temporary assistance to low- and middle-income individuals and families during a period when budgets are often tight.

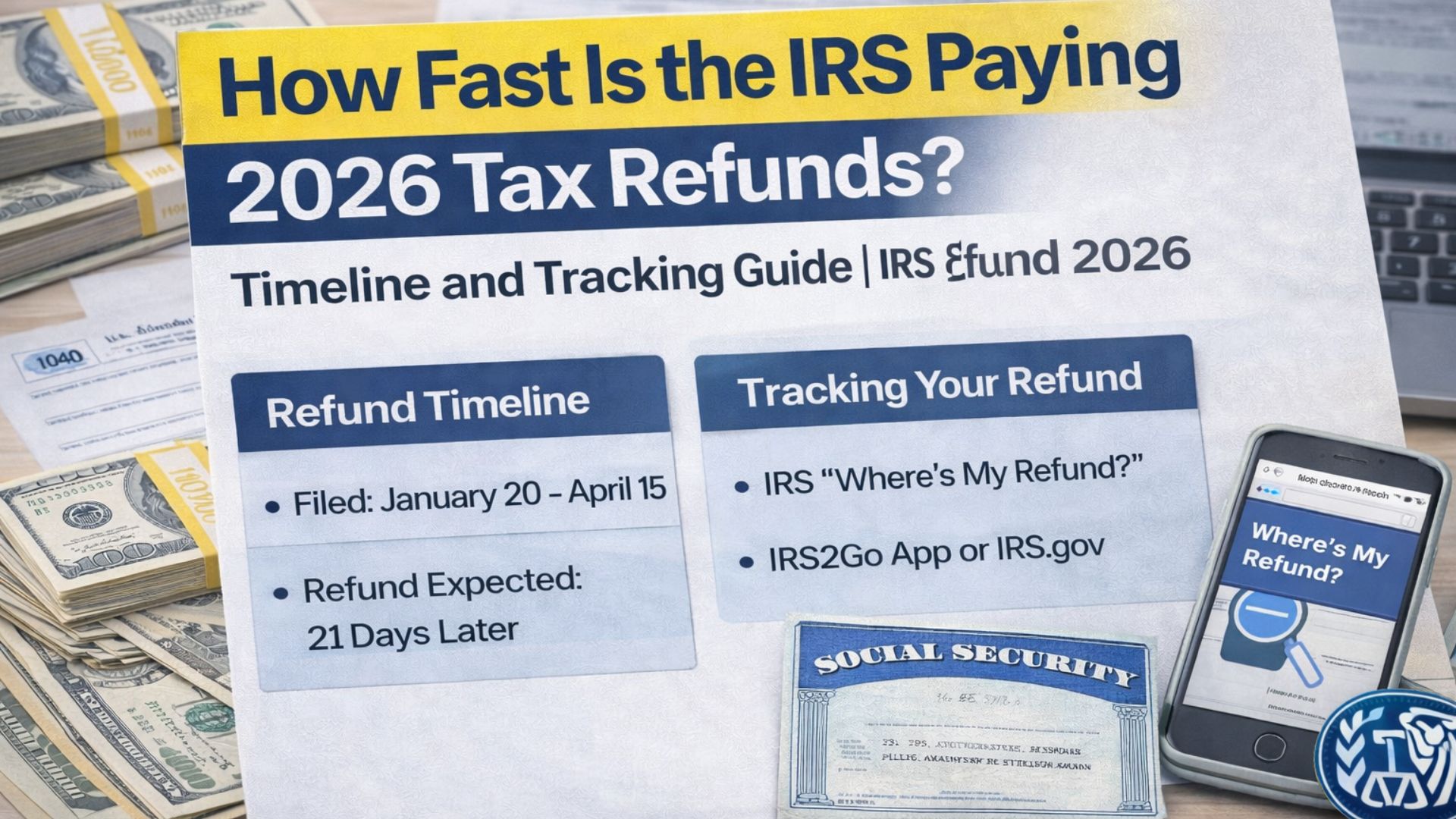

According to available information, the IRS plans to use data from 2024 and 2025 tax returns to determine eligibility. By relying on existing tax records, the agency can identify qualified recipients without requiring most people to fill out new forms. This approach is intended to speed up distribution and reduce paperwork.

Eligibility is expected to depend on income level, filing status, and residency. Income limits may differ for single filers and married couples filing jointly. Families with dependents may qualify under higher thresholds. A valid Social Security number and U.S. residency are generally required. Individuals who have not filed a recent tax return may need to update their information to avoid missing the payment.

Payments are expected to be distributed in phases throughout January 2026. Taxpayers who have direct deposit details on file with the IRS are likely to receive funds first. Those without banking information may receive paper checks or prepaid debit cards by mail later in the month. Processing times can vary depending on bank procedures and mailing delays.

To avoid problems, individuals should confirm that their address and bank account details are current with the IRS. Reviewing recent tax filings and correcting outdated information can help prevent delays.

यह भी पढ़े:

Money Arriving in February 2026: What Social Security and SSDI Beneficiaries Should Understand

Money Arriving in February 2026: What Social Security and SSDI Beneficiaries Should Understand

For many households, $2,000 could help cover rent, groceries, utility bills, or medical costs. Others may choose to reduce debt or strengthen emergency savings. While it does not address long-term financial challenges, it may offer helpful short-term support.

Disclaimer: This article is for informational purposes only and does not provide legal, financial, or tax advice. Payment eligibility, amounts, and timelines depend on official IRS guidance and may change. Readers should consult IRS.gov or a qualified professional for accurate and up-to-date information.