Tax refunds provide important financial relief to millions of Americans each year. For many households, this money is used to pay rent, cover utility bills, reduce credit card debt, or build emergency savings. As the 2026 tax season begins, knowing how the refund process works can help taxpayers plan ahead and avoid unnecessary stress.

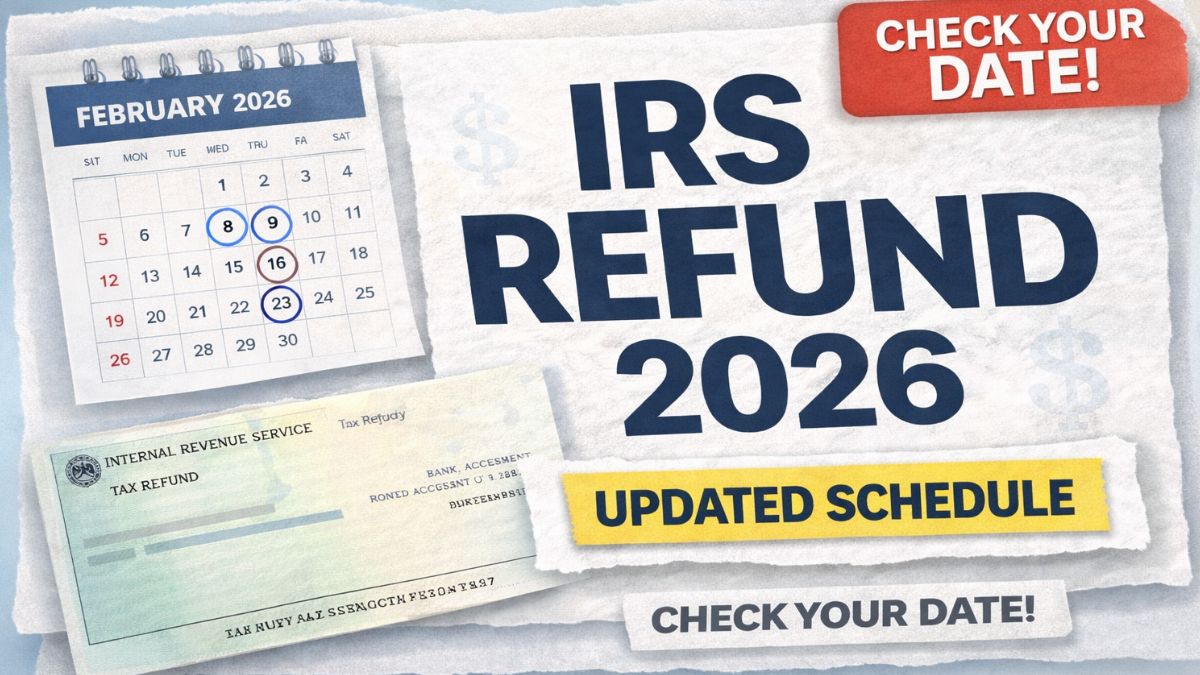

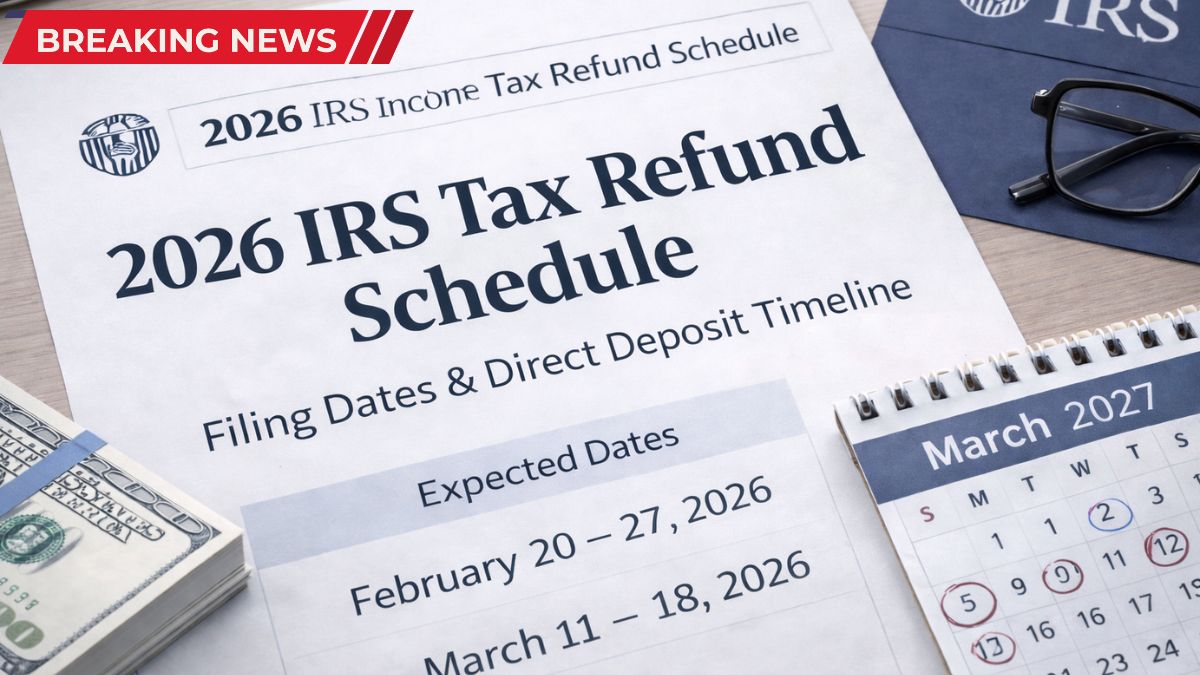

The Internal Revenue Service started accepting federal tax returns for the 2025 tax year in late January 2026. Once a return is submitted and officially accepted, the processing stage begins. For taxpayers who file electronically and choose direct deposit, refunds are typically issued within about 21 days. Electronic filing allows information to move directly into IRS systems, which helps speed up verification. Direct deposit also reduces waiting time because funds are sent straight to a bank account without relying on mail delivery.

Several factors influence how quickly a refund arrives. The date the return is filed plays an important role, as early filers often move through the system sooner. The filing method also matters. Paper returns usually take longer because they must be manually opened and reviewed. Electronic returns, on the other hand, are processed through automated systems that can check income details and other data more efficiently.

Refund timing can also be affected by certain tax credits. Returns that include the Earned Income Tax Credit or the Additional Child Tax Credit are subject to additional review under federal law. The IRS must hold these refunds until at least mid-February to confirm income information and reduce fraud risks. Because of this rule, taxpayers claiming these credits may receive refunds later than others.

Although most refunds are processed smoothly, delays can occur. Errors such as incorrect Social Security numbers, missing documents, mismatched income reports, or identity verification checks can slow the approval process. Even small mistakes may result in additional review before payment is released.

Taxpayers can monitor the status of their refund using official IRS online tracking tools. Updates are generally available within 24 hours after electronic filing or about four weeks after mailing a paper return. The tracking system shows when the return is received, approved, and sent for payment.

Also Read:

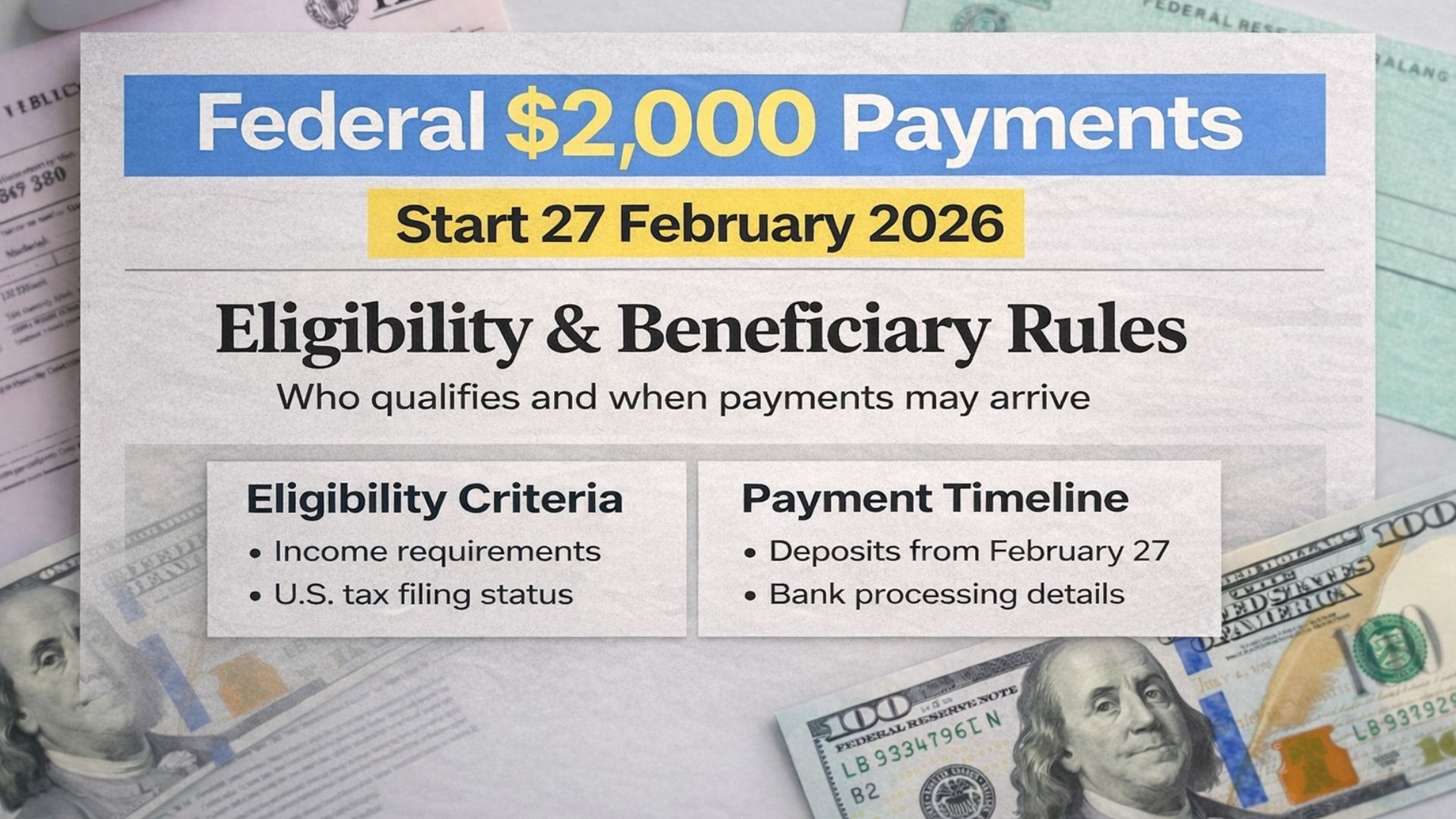

February 2026 IRS $2,000 Payment — Who Qualifies, When It Arrives and Important Details for Families

February 2026 IRS $2,000 Payment — Who Qualifies, When It Arrives and Important Details for Families

Disclaimer: This article is for informational purposes only and does not provide tax, financial, or legal advice. Refund amounts and processing times depend on individual tax circumstances and official IRS guidelines. For accurate and personalized information, consult official IRS resources or a qualified tax professional.