As the 2026 tax season approaches, millions of Americans are preparing to file their federal income tax returns. One of the biggest concerns for taxpayers is knowing when their refund will arrive. Although the Internal Revenue Service does not publish exact payment dates for each person, past trends and official guidance provide a clear idea of how long refunds usually take. Understanding this timeline can help families plan expenses and avoid unnecessary financial stress.

How the IRS Processes Refunds

After a tax return is submitted, the IRS reviews the information to confirm income, credits, and personal details. The speed of this process depends on how the return is filed and whether the details are accurate. Electronic filing is usually processed faster than paper returns because it reduces manual handling. Choosing direct deposit also speeds up delivery compared to receiving a mailed check, which can take additional time.

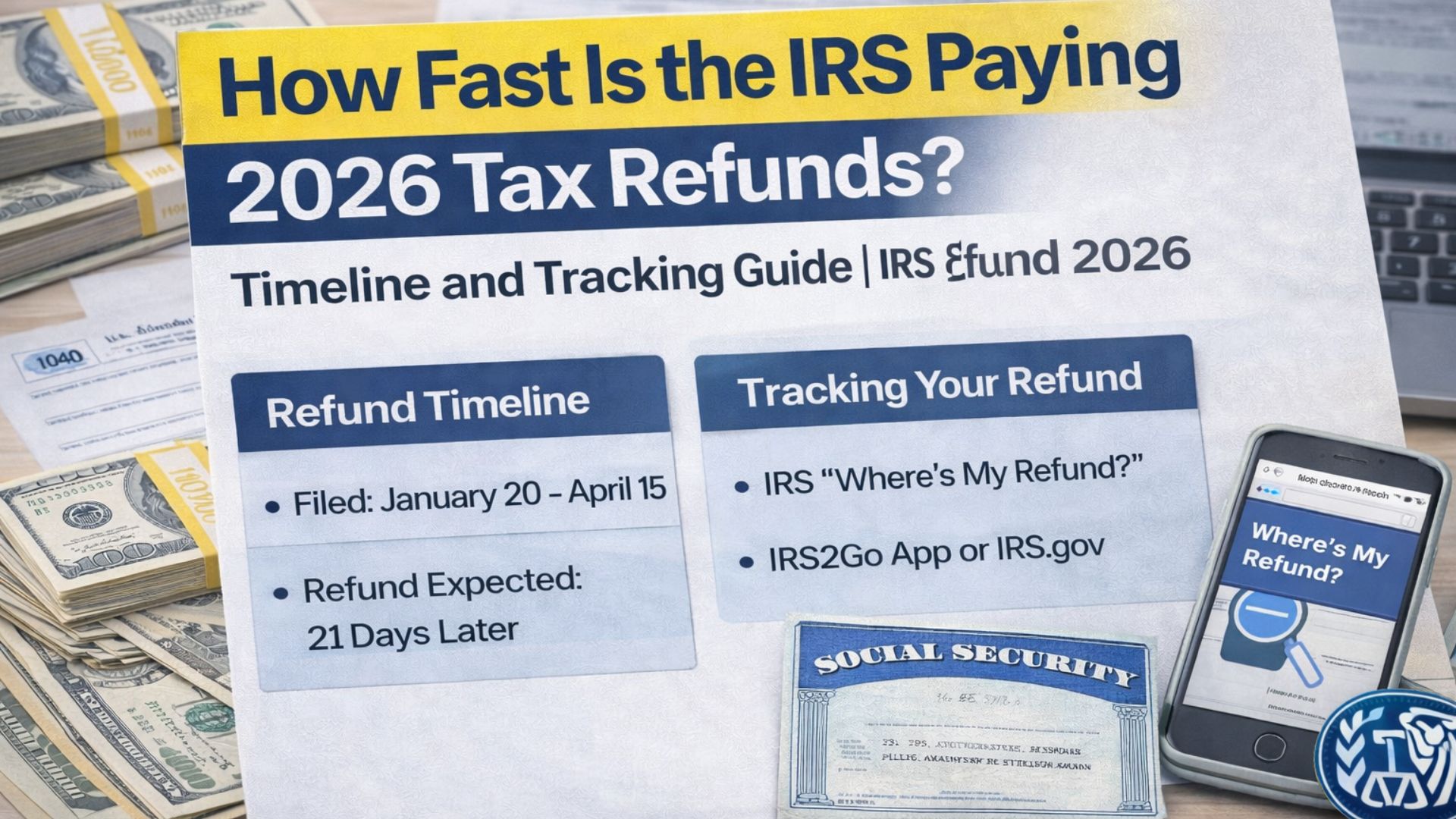

For the 2025 tax year, the IRS is expected to begin accepting returns on January 26, 2026. In most cases, taxpayers who file electronically and choose direct deposit receive refunds within 10 to 21 days after their return is accepted. Simple returns with no errors may be processed even sooner. However, returns that include credits such as the Earned Income Tax Credit or the Additional Child Tax Credit are often held until mid-February due to fraud prevention rules.

Estimated Refund Timeline for 2026

Based on historical patterns, returns filed in late January may result in refunds arriving in early to mid-February. Returns submitted in early February often see refunds by mid to late February. Mid-February filings typically receive refunds in late February or early March. Returns filed closer to the April deadline may take slightly longer due to higher processing volumes. While these dates are estimates, they provide a helpful planning framework.

Common Causes of Refund Delays

Delays can occur for several reasons. Paper returns usually take longer because they require manual review. Errors in Social Security numbers, banking information, or calculations may also slow processing. Identity verification requests and mismatches in income records can pause refunds until the issue is resolved. Filing accurate and complete information is the best way to prevent setbacks.

How to Receive Your Refund Faster

Filing electronically and selecting direct deposit remain the quickest ways to receive a refund. Creating an IRS online account allows taxpayers to monitor their refund status. Responding promptly to any IRS notice also helps avoid extended delays.

यह भी पढ़े:

Money Arriving in February 2026: What Social Security and SSDI Beneficiaries Should Understand

Money Arriving in February 2026: What Social Security and SSDI Beneficiaries Should Understand

Disclaimer: This article is for informational purposes only and does not provide tax, legal, or financial advice. Refund timelines may vary based on individual circumstances and official IRS procedures. Taxpayers should consult IRS.gov or a qualified tax professional for accurate and updated guidance.