As the 2026 tax season approaches, many Americans are getting ready to file their federal income tax returns. One of the biggest questions each year is when refunds will arrive and how much they may be. While the government does not assign exact refund dates to individual taxpayers, previous filing seasons offer a clear idea of how the process usually works.

How Tax Refunds Are Determined

A tax refund is issued when a person has paid more federal income tax during the year than they actually owed. This often happens because employers withhold estimated taxes from paychecks. After a return is filed, the IRS calculates the true tax liability based on income, deductions, and credits. If too much was paid, the extra amount is returned. Refund totals depend on several factors, including yearly earnings, withholding choices, and eligibility for credits such as child-related or education benefits. Updates to tax brackets and withholding rules in 2026 may also influence final refund amounts.

When the IRS Will Begin Processing Returns

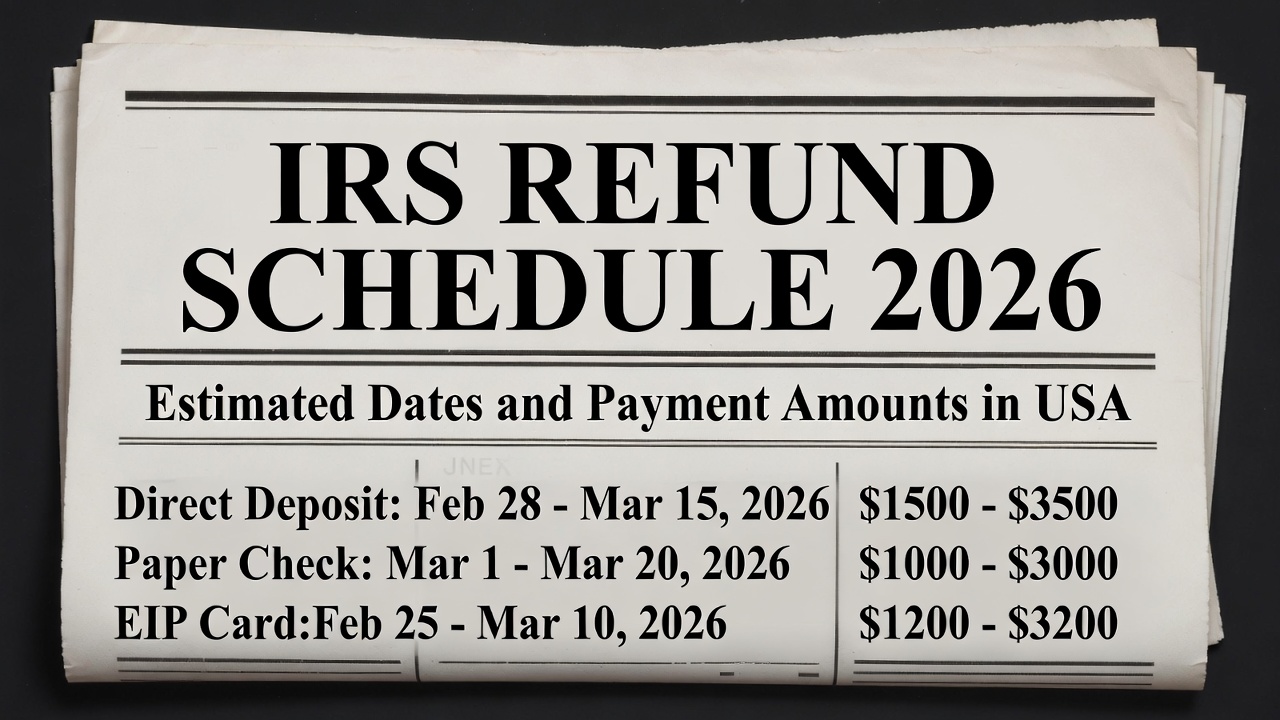

The Internal Revenue Service is expected to start accepting returns for the 2025 tax year in late January 2026. Taxpayers who file soon after the filing season opens often receive their refunds earlier than those who wait. Many electronic filers who select direct deposit begin seeing payments between late January and early February, depending on when their return is accepted.

Mid-February is typically the busiest time for processing, as large numbers of returns are submitted. Refunds continue to be issued through March and early April, especially for those who file later or whose returns require additional review. Individuals who submit returns close to the April deadline may receive refunds after that date.

Also Read:

IRS Today Announced $2,000 Direct Deposit for All in February 2026, Payment Schedule and Eligibility

IRS Today Announced $2,000 Direct Deposit for All in February 2026, Payment Schedule and Eligibility

The Fastest Way to Receive a Refund

The method chosen for payment significantly affects timing. Direct deposit is generally the quickest option and often results in funds arriving within two to three weeks after acceptance. Paper checks take longer because they must be printed and mailed, which can add several weeks to the process.

Possible Reasons for Delays

Also Read:

IRS Confirms February Refund Date

IRS Confirms February Refund Date

Errors in personal information, missing income forms, or differences between a return and IRS records can slow processing. Identity verification checks and high filing volumes may also cause delays. Carefully reviewing all information before submitting a return helps reduce these risks.

Tracking Refund Status

Taxpayers can monitor progress using official IRS tracking tools. Updates usually appear after the return has been accepted and processed.

Disclaimer: This article is for informational purposes only and does not provide tax, legal, or financial advice. IRS rules, timelines, and refund amounts may vary based on individual situations. For accurate guidance, consult official IRS resources or a qualified tax professional.