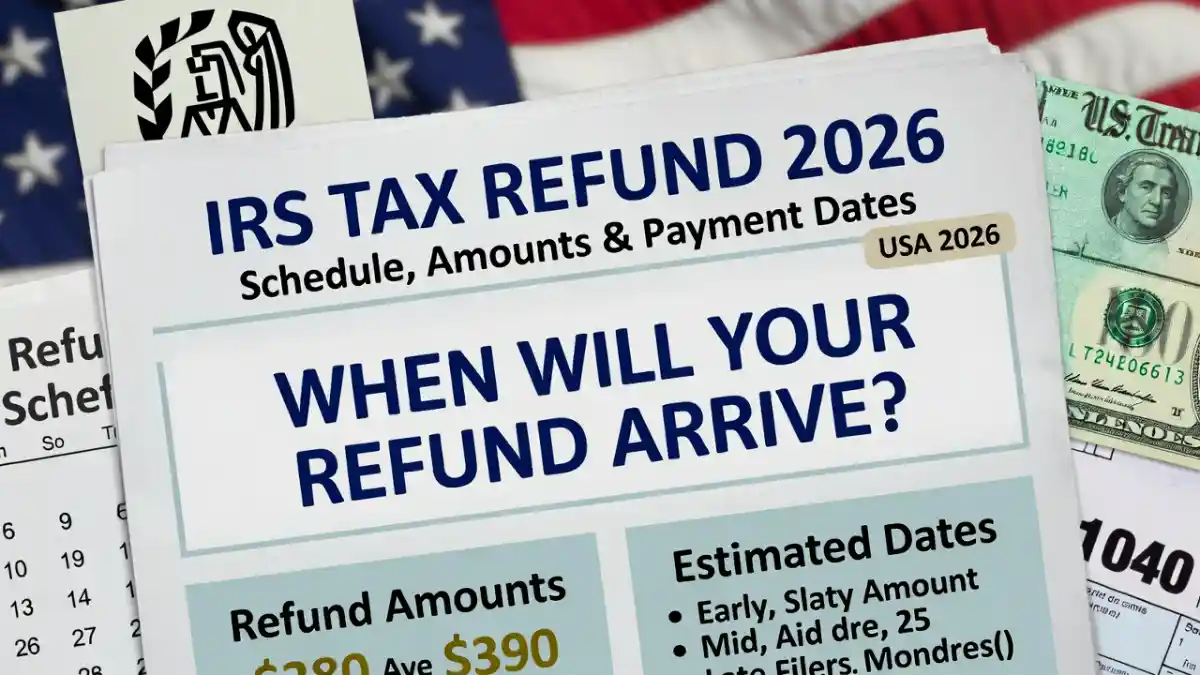

As the 2026 tax season approaches, many taxpayers are preparing to file their federal returns and estimate when their refunds might arrive. For countless families, a refund is more than extra income. It can help cover rent, utility bills, loan payments, or strengthen savings. While there is no universal refund date, learning how the system works can reduce uncertainty and help with financial planning.

How a Tax Refund Is Calculated

A refund is issued when you pay more federal income tax during the year than you actually owe. Most employees have taxes automatically withheld from their paychecks. When you file your annual return, your total income is reviewed and your final tax liability is calculated. After deductions and credits are applied, the system determines whether you overpaid. If your total payments exceed what you owed, the difference is returned to you as a refund.

Not everyone receives money back. Some taxpayers may owe additional tax if too little was withheld. Others may break even. The final outcome depends on income level, withholding choices, and eligibility for credits.

Factors That Influence Refund Amounts

Refund amounts vary widely because every financial situation is different. Annual income plays a key role, as does the amount withheld throughout the year. Tax credits can significantly increase refunds, especially those related to children, education expenses, or lower-income households. Deductions also reduce taxable income, which may lead to a larger refund.

यह भी पढ़े:

IRS Today Announced $2,000 Direct Deposit for All in February 2026, Payment Schedule and Eligibility

IRS Today Announced $2,000 Direct Deposit for All in February 2026, Payment Schedule and Eligibility

Life changes can also affect your tax outcome. Starting a new job, changes in marital status, having a child, or adjusting your workplace withholding form can all influence your final refund.

When Refunds Are Issued

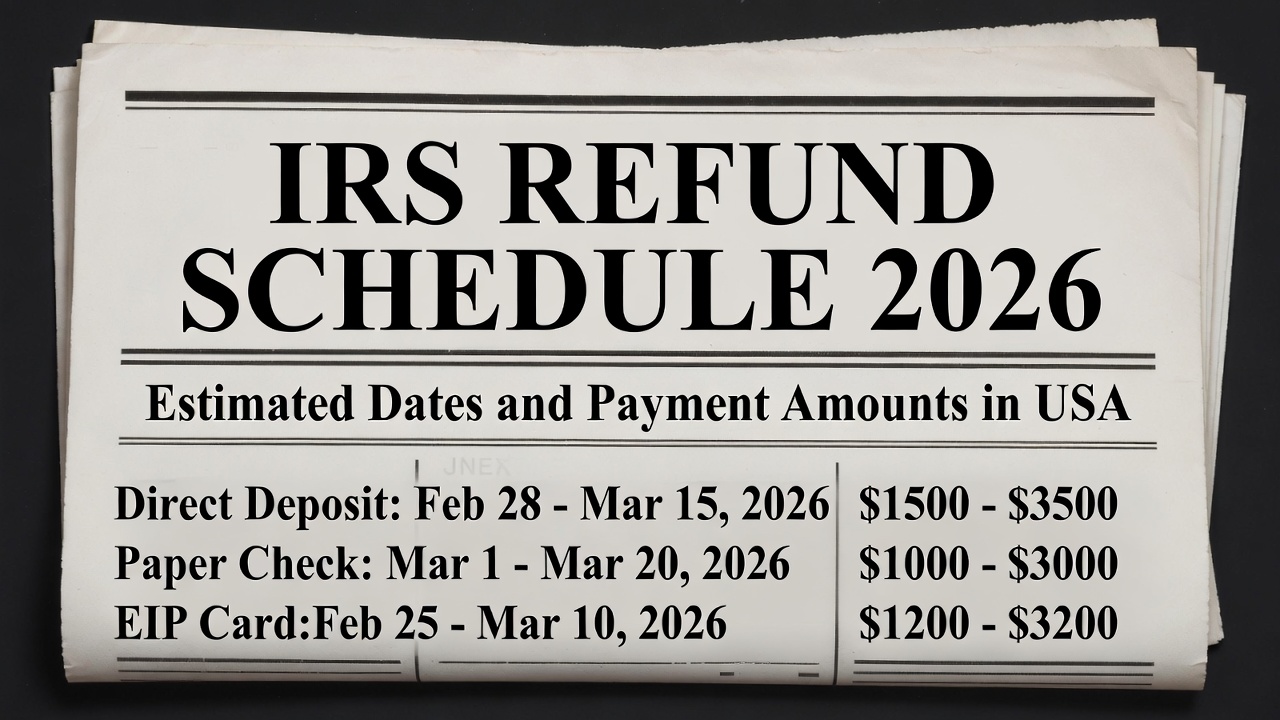

The federal filing season usually opens in late January. Once your return is accepted, processing begins. Electronic filing with direct deposit is typically the fastest method. Many taxpayers receive refunds within two to three weeks of acceptance, although this timeline is not guaranteed.

यह भी पढ़े:

IRS Confirms February Refund Date

IRS Confirms February Refund Date

Paper returns take longer because they require manual handling. During busy periods, processing times may extend further. Filing early and ensuring accuracy can help avoid delays.

Common Reasons for Delays

Errors such as incorrect Social Security numbers, wrong bank details, or missing forms can slow processing. Identity verification checks and certain refundable credits may also require additional review. Carefully checking your return before submission reduces the risk of setbacks.

How to Track Your Refund

After filing, you can monitor your refund status through the official online tracking tool provided by the tax authority. Updates generally appear after the return is accepted and are refreshed once daily. Using this tool is more reliable than relying on estimated refund calendars.

Planning Ahead

Keeping records organized, filing electronically, and choosing direct deposit can help speed up the process. Viewing your refund as part of your yearly financial plan rather than guaranteed extra income can also support better budgeting decisions.

Disclaimer: This article is for informational purposes only and does not provide tax, financial, or legal advice. Refund amounts and processing timelines depend on individual circumstances and official tax authority procedures. For personalized guidance, consult official government resources or a qualified tax professional.