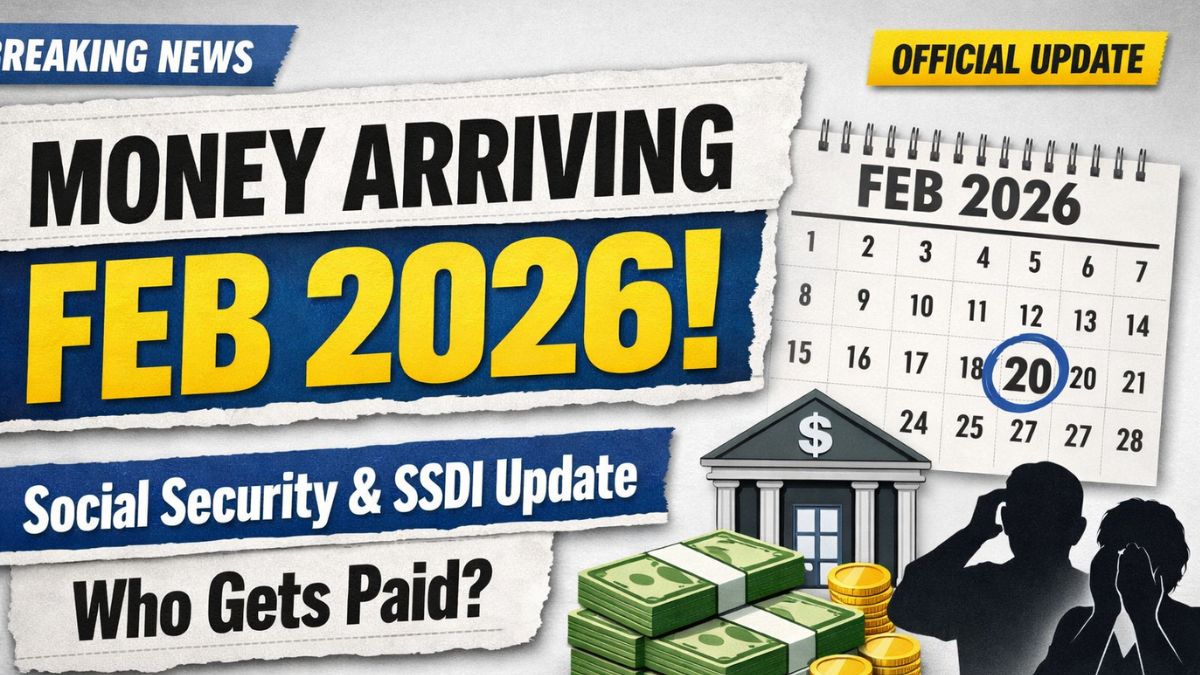

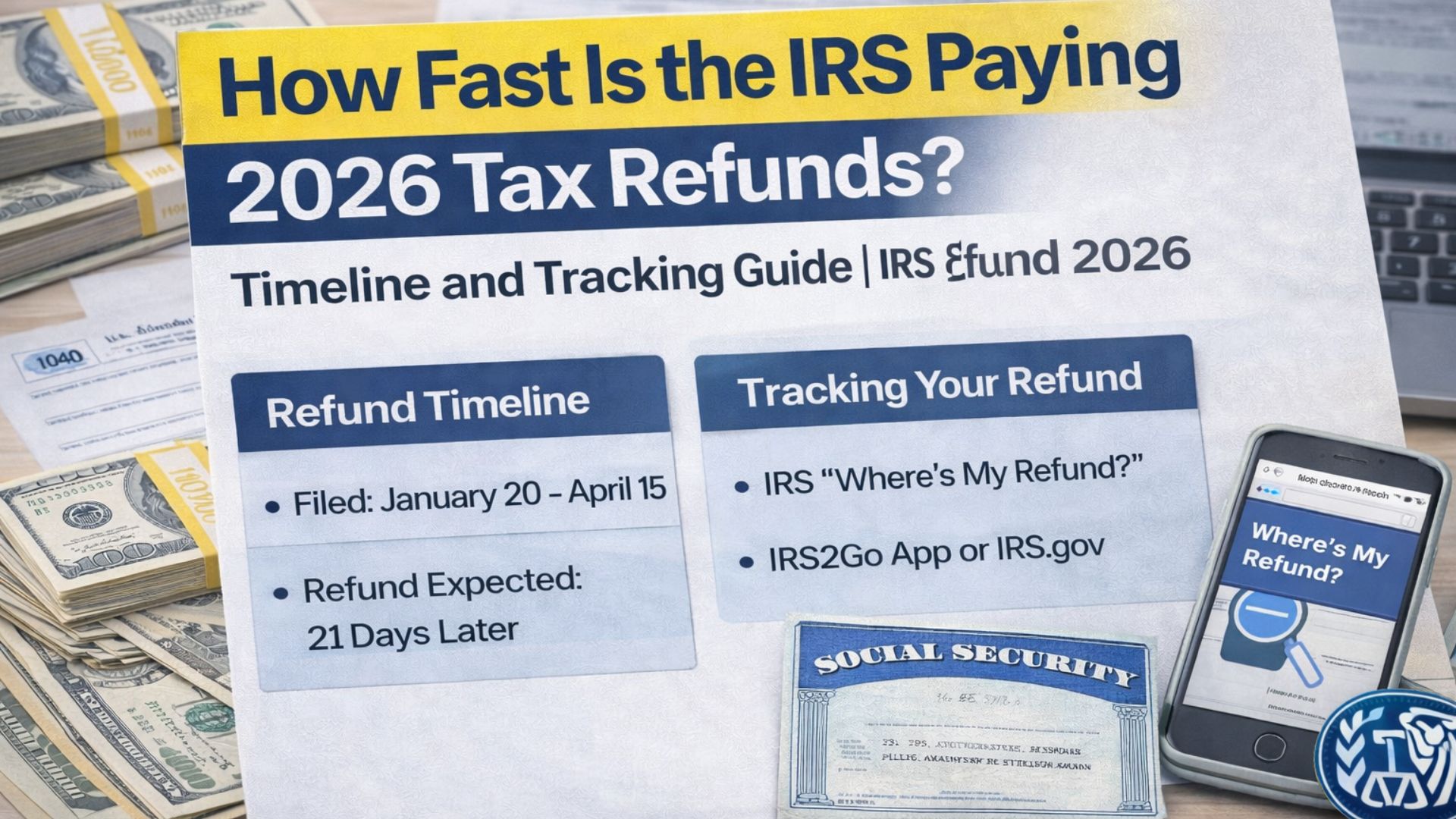

February is one of the busiest months of the tax season. Many taxpayers who filed their 2025 federal return are waiting for their refunds and checking their bank accounts regularly. It is important to know that refunds are not sent to everyone on the same day. Each return is processed separately, and the timing depends on several factors. Knowing how the system works can help reduce worry and allow better financial planning.

When Refund Processing Actually Begins

Refund processing starts only after the IRS officially accepts your return. Acceptance means your return passed the first technical checks and entered the processing system. It does not mean your refund has already been approved. After acceptance, the IRS compares your reported income and tax details with information from employers and financial institutions. If everything matches and no issues appear, the return continues through automated processing.

Electronic returns move faster because all data is submitted digitally. Paper returns must be opened and entered manually, which adds extra time. Simple returns with standard income and no special credits are usually processed more quickly than complex returns.

How Long Refunds Usually Take

There is no single national refund day in February. Refunds are released in batches as returns finish processing. For most people who file electronically and choose direct deposit, refunds are often issued within about twenty-one days after acceptance. Some taxpayers receive their money sooner if their return is straightforward. Others may wait longer if additional review is required.

Direct deposit is normally the fastest way to receive funds. Paper checks take extra time because they must be printed and mailed. Postal delays can extend the waiting period further.

Common Reasons for Delays

Several issues can slow down a refund. Identity verification is a common cause. If the IRS needs more information, it will send a letter with instructions. Processing pauses until you respond. Errors such as incorrect Social Security numbers, math mistakes, or mismatched income details can also trigger manual review.

यह भी पढ़े:

Money Arriving in February 2026: What Social Security and SSDI Beneficiaries Should Understand

Money Arriving in February 2026: What Social Security and SSDI Beneficiaries Should Understand

Returns claiming certain refundable credits may require additional checks. High filing volume during peak season can also slow processing temporarily. In some cases, government debts may reduce or offset the refund amount.

How to Track Your Refund

The safest way to check your refund status is by using the official IRS online tracking tool or mobile app. These systems show whether your return is received, approved, or sent. Updates usually appear once per day. Checking multiple times in one day will not change the status.

If more than three weeks have passed since your electronic return was accepted, review the tracking tool for messages. If needed, follow the instructions provided by the IRS.

यह भी पढ़े:

IRS Tax Refund 2026 Guide: Processing Timelines, Key Rules, and What Taxpayers Should Expect

IRS Tax Refund 2026 Guide: Processing Timelines, Key Rules, and What Taxpayers Should Expect

Understanding the February 2026 refund process helps set realistic expectations. Filing electronically, choosing direct deposit, and checking your information carefully are the best ways to avoid delays.

Disclaimer: This article is for informational purposes only and does not provide tax, legal, or financial advice. Refund timelines depend on individual tax details and official IRS procedures. For accurate guidance, consult the official IRS website or a qualified tax professional.