The Internal Revenue Service has announced that federal income tax refunds for the 2026 filing season will begin reaching taxpayers in February. This confirmation provides reassurance to millions of Americans who rely on their annual refunds to cover important expenses. For many households, a refund is used to pay rent, handle medical costs, reduce debt, or strengthen savings after a year of rising prices. With return processing already underway, payments are expected to appear in bank accounts throughout the month.

How Filing Method Affects Refund Speed

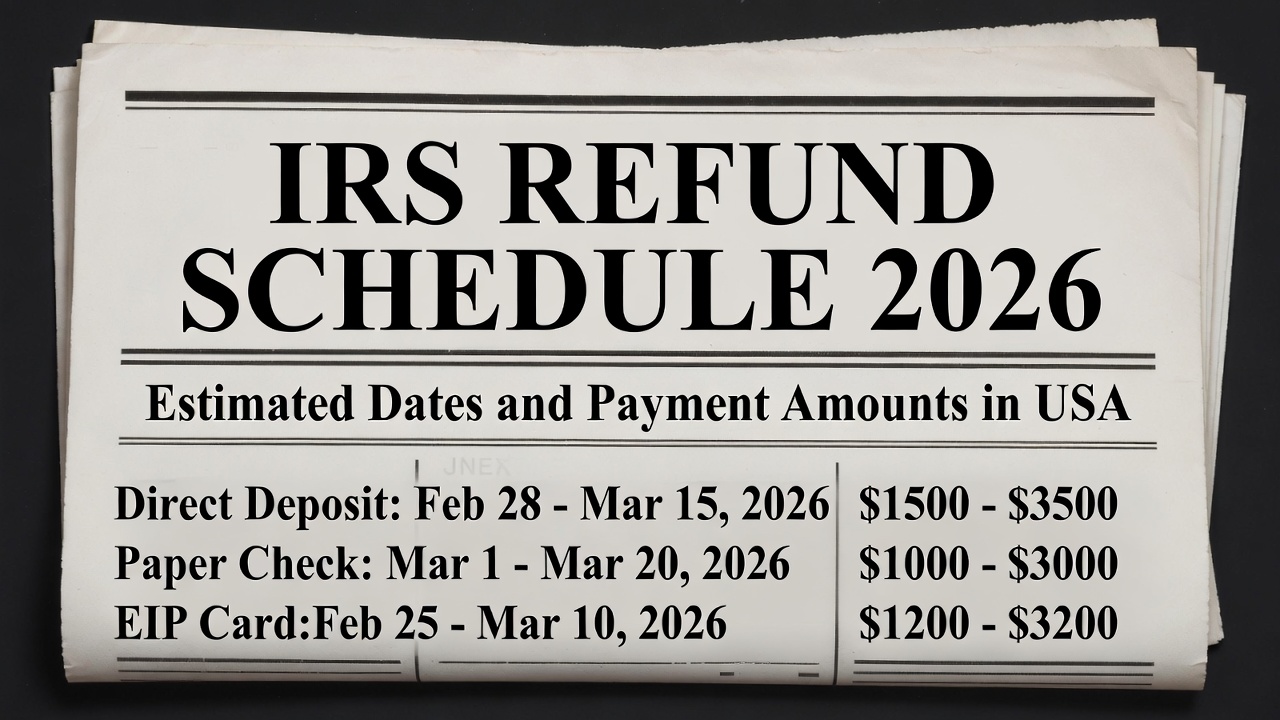

The timing of a refund depends mainly on how and when a tax return is submitted. Taxpayers who filed electronically and selected direct deposit are likely to receive their refunds first. In many situations, electronic filers may see their payment within 10 to 21 days after the IRS accepts the return. Paper returns, however, take longer because they must be reviewed manually before a refund is approved. In addition, mailed checks require extra delivery time compared to electronic transfers.

The Importance of Accuracy

Correct and complete information plays a major role in how quickly a refund is issued. Returns that include accurate personal details, correct income reporting, and no calculation errors usually move through the system more smoothly. Filing early can also help, as it places the return earlier in the processing queue. Choosing direct deposit instead of a paper check is another way to reduce waiting time and avoid postal delays.

Reasons Some Refunds May Be Delayed

While many taxpayers will receive their refunds without problems, some returns may require additional review. Delays can happen if there are incorrect Social Security numbers, mismatched income records, missing documents, or identity verification concerns. Certain refundable tax credits require extra checks to prevent fraud, which can extend the processing period. These protective measures are designed to ensure accuracy and safeguard taxpayer funds.

Tracking Your Refund Status

Taxpayers can monitor their refund progress using official IRS online tracking tools. Updates generally become available within 24 hours after an electronic return is accepted. To check status, individuals need their Social Security number, filing status, and the exact refund amount listed on their return. Using official resources helps reduce confusion and prevents reliance on unofficial sources.

Also Read:

IRS Today Announced $2,000 Direct Deposit for All in February 2026, Payment Schedule and Eligibility

IRS Today Announced $2,000 Direct Deposit for All in February 2026, Payment Schedule and Eligibility

Planning Ahead for February Payments

For many families, February refunds are an important part of financial planning. Knowing that refunds are officially beginning this month allows households to budget more confidently and prepare for upcoming expenses. Filing electronically, reviewing information carefully, and selecting direct deposit remain the most reliable ways to receive funds promptly.

Disclaimer: This article is for informational purposes only and does not provide tax, legal, or financial advice. Refund timing and eligibility depend on individual tax circumstances and official IRS guidelines. For personalized assistance, consult the IRS website or a qualified tax professional.