The beginning of 2026 has placed financial pressure on many American households. After holiday expenses, increased heating bills, rising grocery prices, and regular monthly costs, budgets are stretched thin. In this environment, news about a one-time $2,000 IRS payment scheduled for February 2026 has drawn significant attention. For families managing essential expenses, this payment is being viewed as short-term relief during a challenging period.

This $2,000 payment is described as part of a recently approved federal support measure. It is not a permanent program or recurring monthly benefit. Instead, it is intended to provide temporary assistance to households dealing with higher living costs. The purpose is to help cover basic needs such as rent, food, utilities, childcare, transportation, and medical expenses. By releasing funds early in the year, the government aims to reduce financial strain at a time when many families face larger bills.

The Internal Revenue Service is responsible for distributing the funds. To simplify the process and avoid delays, officials are relying on existing tax records rather than requiring new applications. Most eligible individuals are not expected to complete additional paperwork. For those who have bank information already on file from recent tax returns, payments will be sent by direct deposit. Individuals without direct deposit details may receive paper checks through the mail.

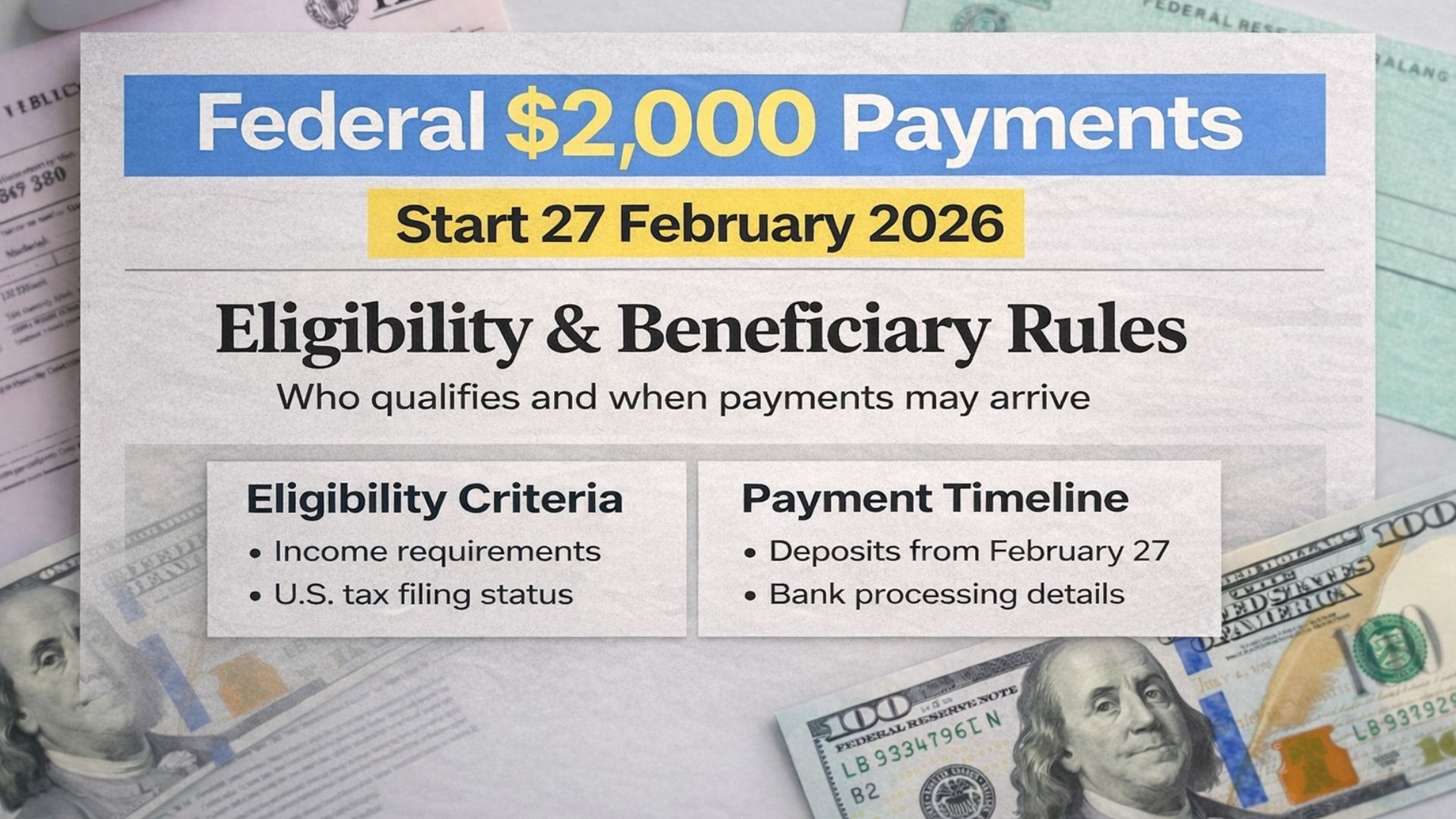

Eligibility is primarily based on income and household details reported on 2024 tax returns filed in 2025. The program focuses on low- and middle-income families. Income limits are designed to direct assistance to households facing the greatest financial difficulty. Family size is also considered. Households with dependents may have a higher likelihood of qualifying compared to individuals with higher earnings. Those whose income slightly exceeds the established limits may not receive the full amount or may not qualify at all.

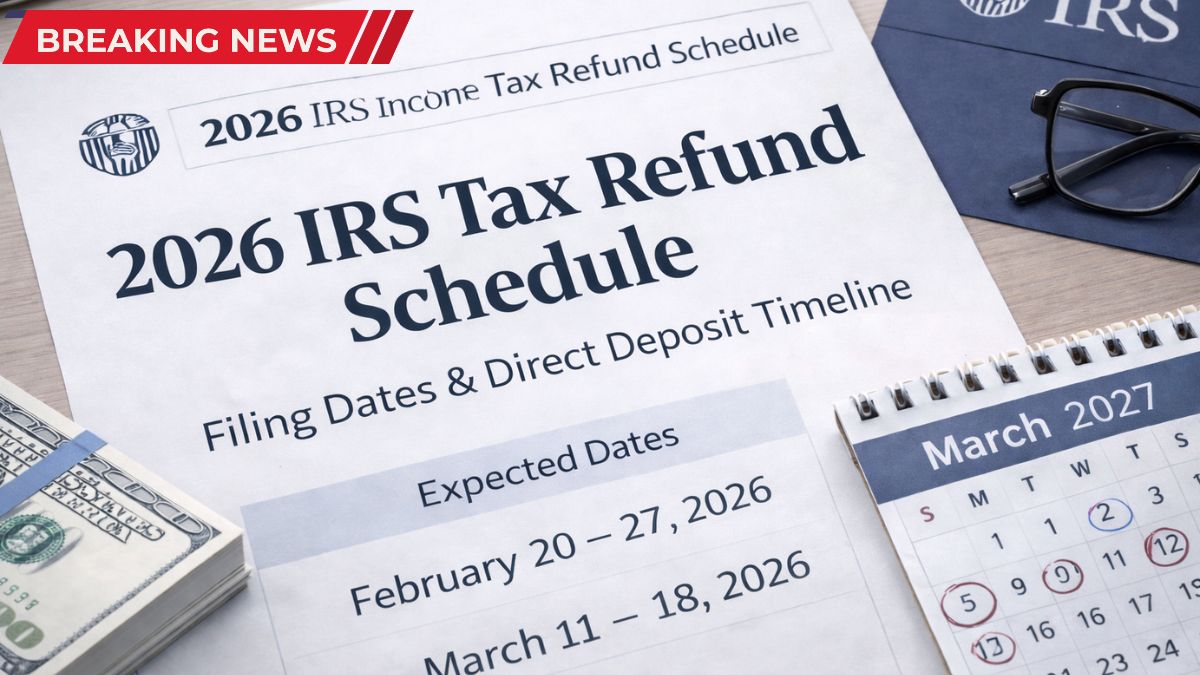

According to current guidance, payment distribution is expected to begin around the week of February 12, 2026. Because millions of payments will be processed, deposits will likely be sent in stages rather than on a single day. Some recipients may receive their funds earlier than others. An online tracking tool is expected to allow individuals to check their payment status once processing begins.

For many households, $2,000 can provide meaningful assistance. It may help reduce overdue bills, manage debt, or create a small emergency fund. However, this support is temporary and not guaranteed for every taxpayer. Staying informed through official government sources is essential to avoid misunderstandings.

Disclaimer: This article is for informational purposes only and does not provide legal, financial, or tax advice. Eligibility requirements, payment dates, and program details may change based on official government updates. Individuals should consult official IRS sources or a qualified professional for guidance specific to their situation.