In early 2026, public attention has focused on a proposed $2,000 direct deposit program expected to begin on February 9, 2026. With the cost of rent, groceries, utilities, and healthcare still high, many households are looking for short-term financial support. This proposed initiative is described as a targeted financial relief effort using a fully digital payment system to deliver funds quickly and securely.

The main goal of the program is to provide temporary financial assistance through electronic transfers only, avoiding delays linked to paper checks. The system would use digital identity verification and automated approval tools to reduce paperwork and speed up processing. Once eligibility is confirmed, funds would be transferred directly to the recipient’s verified bank account.

Eligibility is expected to depend on income limits, residency requirements, and compliance with federal guidelines. Income details would likely be reviewed through recent tax filings or official records. Priority processing may be given to seniors, individuals with disabilities, and low-income households, ensuring that vulnerable groups receive faster support.

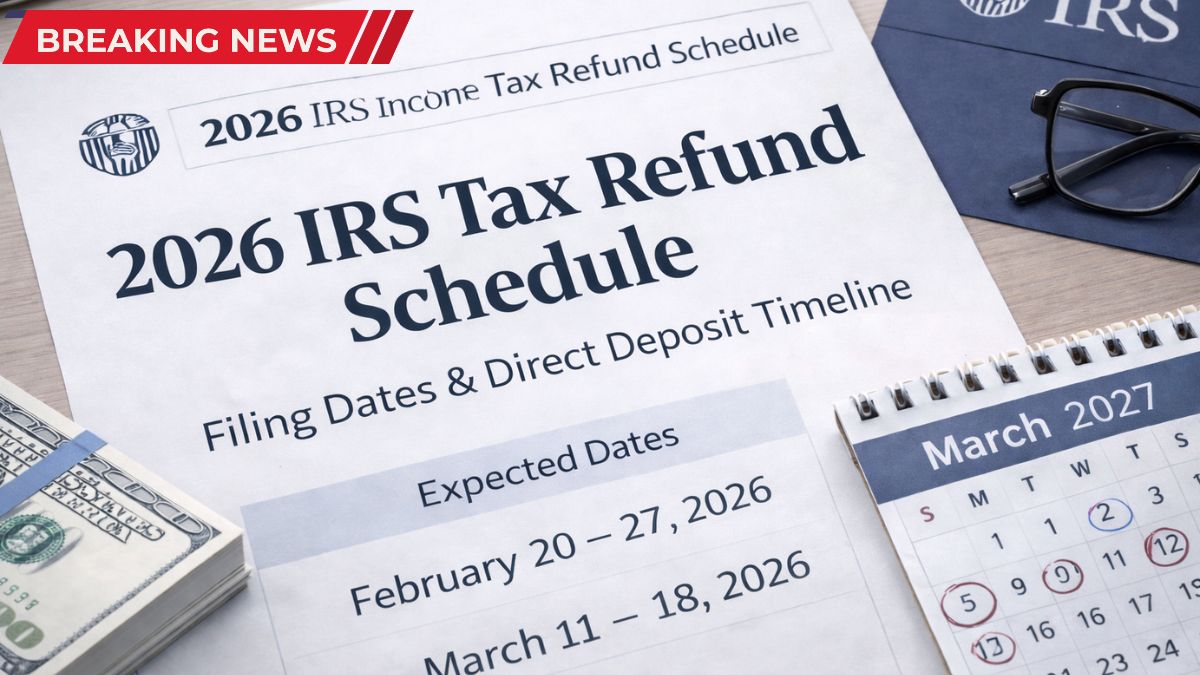

The rollout is planned in phases. Verification and bank detail updates are scheduled to begin on February 1, 2026. Deposits are expected to start on February 9 for early verified applicants. February 20 is the final deadline to complete verification and update banking information. Missing this deadline could delay payment to a later phase.

All payments under this plan would be issued exclusively through direct deposit. Paper checks are not included. Once approved, the $2,000 amount would be electronically transferred to the bank account registered under the verified identity. Confirmation notifications may be sent after processing. Accurate banking details are critical to avoid delays.

To protect against fraud, the system would include safeguards. Each eligible individual or household would receive only one payment, and bank accounts must match official identity records. Submitting false information could result in disqualification or legal consequences.

Also Read:

February 2026 IRS $2,000 Payment — Who Qualifies, When It Arrives and Important Details for Families

February 2026 IRS $2,000 Payment — Who Qualifies, When It Arrives and Important Details for Families

Disclaimer: This article is for informational purposes only and does not provide financial, legal, or tax advice. Program details, eligibility rules, and payment timelines depend on official government decisions and may change. Readers should rely on verified government announcements for the most accurate and up-to-date information.