The 2026 tax filing season is now underway, and millions of Americans are preparing their returns while wondering how much money they might receive back. With the cost of housing, food, and utilities still high, many families depend on their tax refunds to handle essential expenses or rebuild savings. This year, attention has grown after officials suggested that average refunds could increase by around $1,000 or more for many taxpayers.

The Internal Revenue Service officially started accepting 2025 federal tax returns on January 26, 2026. Anyone who paid more federal income tax than required during the year may qualify for a refund. In addition, taxpayers with lower or moderate incomes may benefit from refundable tax credits, which can generate a refund even if no federal income tax was owed.

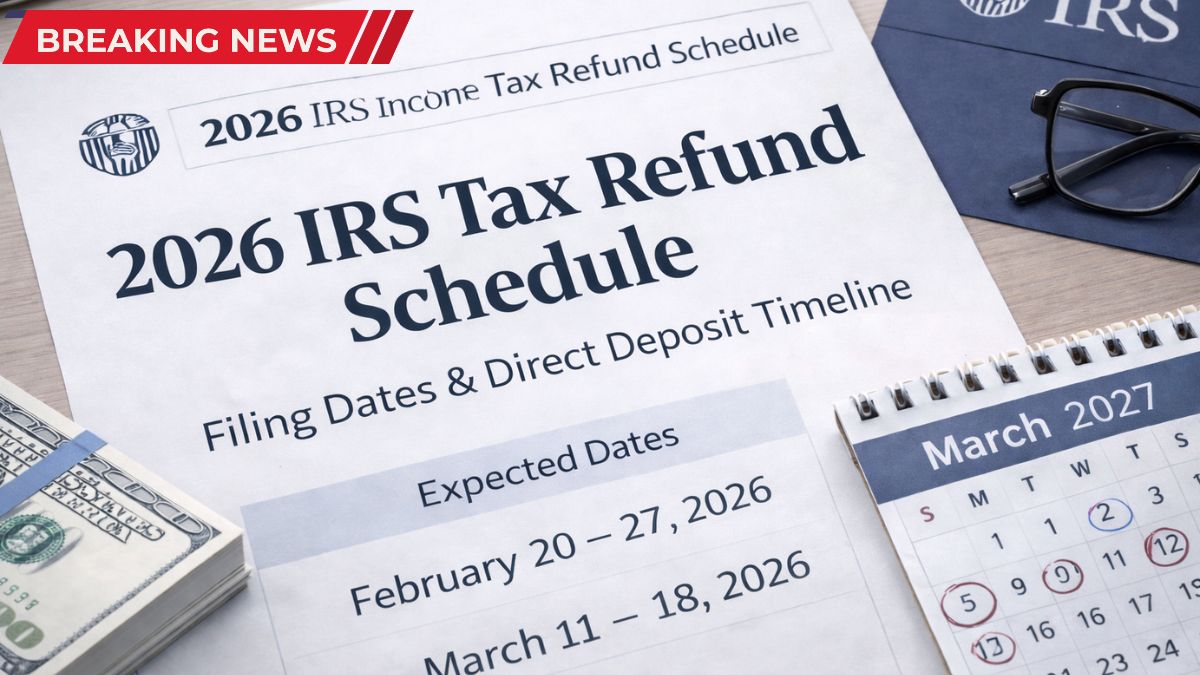

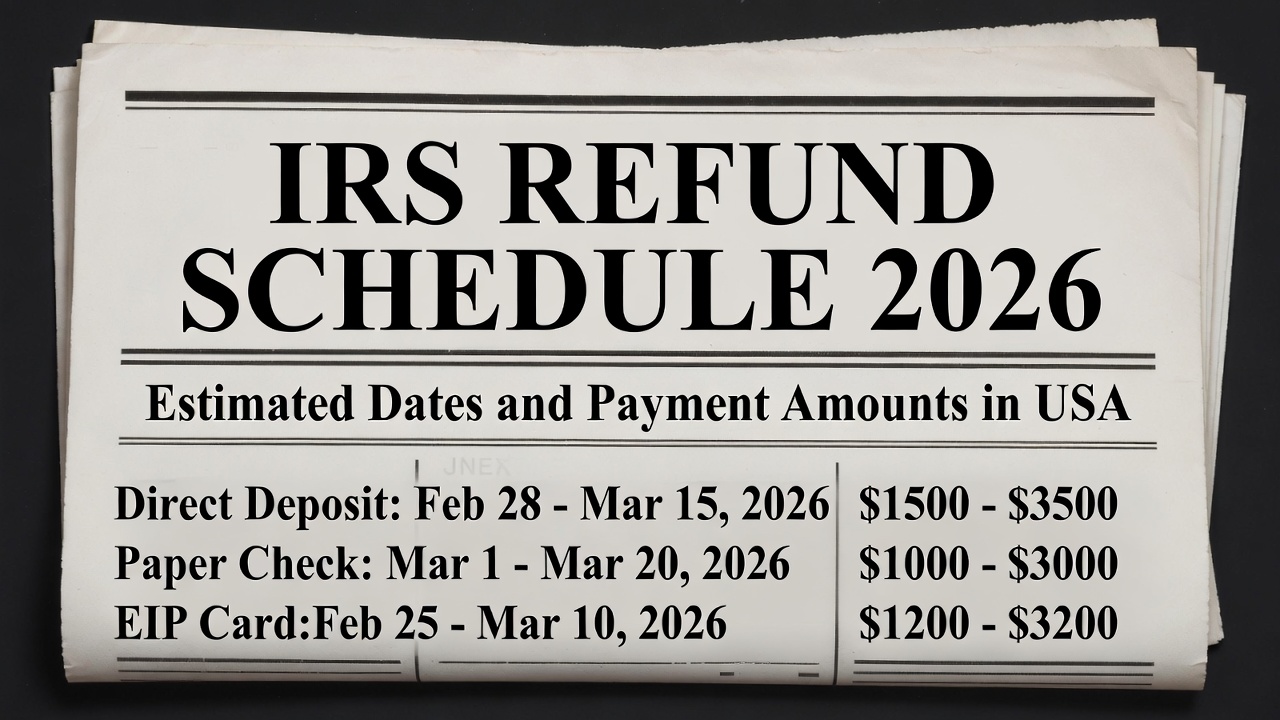

Filing method plays an important role in how quickly money arrives. The IRS explains that taxpayers who file electronically and choose direct deposit usually receive refunds within 21 days or less. This remains the fastest and safest option. Paper returns generally take longer because they must be opened and reviewed manually. In many cases, mailed refunds may take four weeks or more to arrive, especially if a paper check is issued.

Some taxpayers should expect additional processing time. Returns that include the Earned Income Tax Credit or the Additional Child Tax Credit require extra review steps. Because of these verification procedures, many of these refunds are expected to be delivered by early March rather than in February.

Refund amounts may be higher in 2026 due to recent adjustments in tax rules. The standard deduction has increased to $15,750 for single filers and $31,500 for married couples filing jointly, which reduces taxable income. Taxpayers aged 65 and older receive an additional deduction that can further lower their tax bill.

Family-related credits have also been updated. The Child Tax Credit has increased to $2,200 per child, and eligible families may receive up to $1,700 per child as a refundable amount. The Earned Income Tax Credit can provide as much as $7,830, depending on income and family size.

To stay informed, taxpayers can track their refund status using the official “Where’s My Refund?” tool on the IRS website. This online system shows when a return is received, approved, and sent for payment.

Disclaimer: This article is for informational purposes only and does not provide tax, legal, or financial advice. Refund amounts, eligibility requirements, and processing times depend on individual tax circumstances and current IRS policies. For personalized guidance, consult official IRS resources or a qualified tax professional.