As February 2026 gets closer, many Americans are reading online posts claiming that the IRS is sending a new $2,000 direct deposit to everyone. These messages have spread quickly on social media, creating hope for families who are waiting for extra financial support. However, there is no official confirmation of a universal $2,000 stimulus payment. What people are actually seeing are regular tax refunds that happen every year during filing season.

Why the $2,000 Amount Is Being Discussed

The number $2,000 is not random. During tax season, many taxpayers receive refunds close to this amount. This usually happens when more federal tax was withheld from paychecks than the person actually owed. When refundable credits such as the Earned Income Tax Credit or Child Tax Credit are added, the total refund may increase further. Because many early filers receive similar refund amounts, some online users mistakenly describe these payments as a new government program.

Recent updates to tax rules may also explain why some refunds appear larger. Changes in deductions or withholding during 2025 could have led some workers to overpay taxes. When those extra payments are returned, the refund may look like a special deposit, even though it is simply part of the normal tax process.

How IRS Refund Timing Works

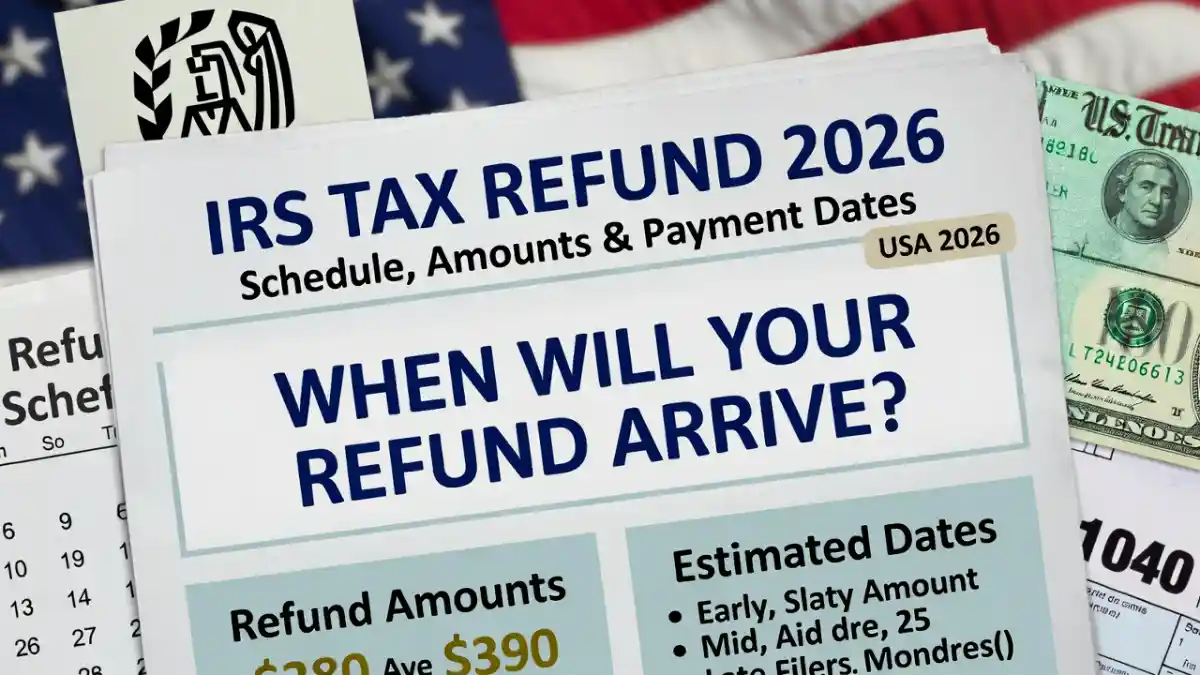

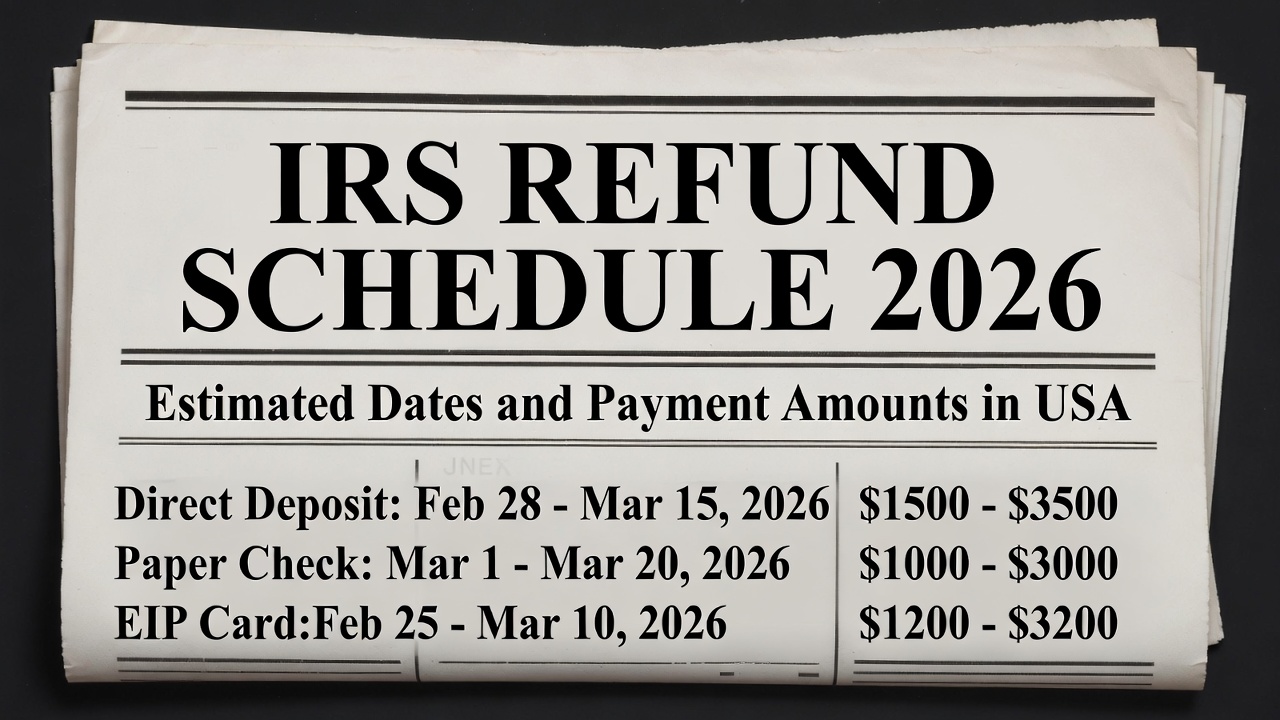

The IRS began accepting 2025 tax returns in late January 2026. Taxpayers who file electronically and select direct deposit often receive their refunds within 10 to 21 days after their return is accepted. Direct deposit remains the fastest way to receive funds. Paper returns and mailed checks usually take much longer because they require manual handling and postal delivery.

Some returns may take extra time. Returns claiming certain refundable credits or containing errors may be reviewed more carefully, which can delay payment into late February or March.

No Guaranteed Refund Amount

There is no fixed refund amount for all taxpayers. Refunds depend on income, filing status, tax withholding, and credits claimed. Some people may receive around $2,000, others may receive more, and some may owe taxes instead.

It is important to remember that tax refunds are not stimulus payments. Any nationwide relief payment would require approval by Congress and a formal announcement from federal authorities. No such program has been approved for February 2026.

Disclaimer: This article is for informational purposes only and does not provide tax, legal, or financial advice. As of February 2026, there is no approved nationwide $2,000 IRS stimulus payment. Refund amounts and timelines depend on individual tax situations and official IRS procedures. For accurate and personalized guidance, consult IRS.gov or a qualified tax professional.