In recent weeks, many social media posts and online articles have suggested that the IRS has approved a $2,000 direct deposit for all Americans in February 2026. These claims have spread quickly and created excitement among families who are dealing with high living costs. At the same time, the reports have caused confusion. As tax season begins, it is important to separate verified information from online speculation.

No Universal $2,000 Payment Has Been Approved

At this time, the Internal Revenue Service has not announced a nationwide $2,000 payment for every taxpayer. There is no new stimulus package or automatic deposit authorized for all Americans. Any large-scale federal payment would require Congress to pass legislation and for it to be signed into law. As of now, no such law has been enacted. Without official approval, a universal payment cannot legally be issued.

Why These Rumors Are Circulating

The confusion appears to be linked to regular tax refunds that many people receive during filing season. It is common for refunds to total around $2,000, especially for households that qualify for certain tax credits or had more tax withheld from their paychecks than necessary. When screenshots of similar refund amounts are shared online, they are sometimes presented as if they are part of a new government program. In reality, these payments are simply standard refunds based on individual tax returns.

How Refund Amounts Are Determined

A tax refund is issued when a taxpayer has paid more federal income tax during the year than they actually owed. This can happen through payroll withholding or estimated tax payments. Refundable tax credits, such as those related to children or earned income, may increase the final refund total. However, the amount varies for each person depending on income, credits claimed, and tax liability.

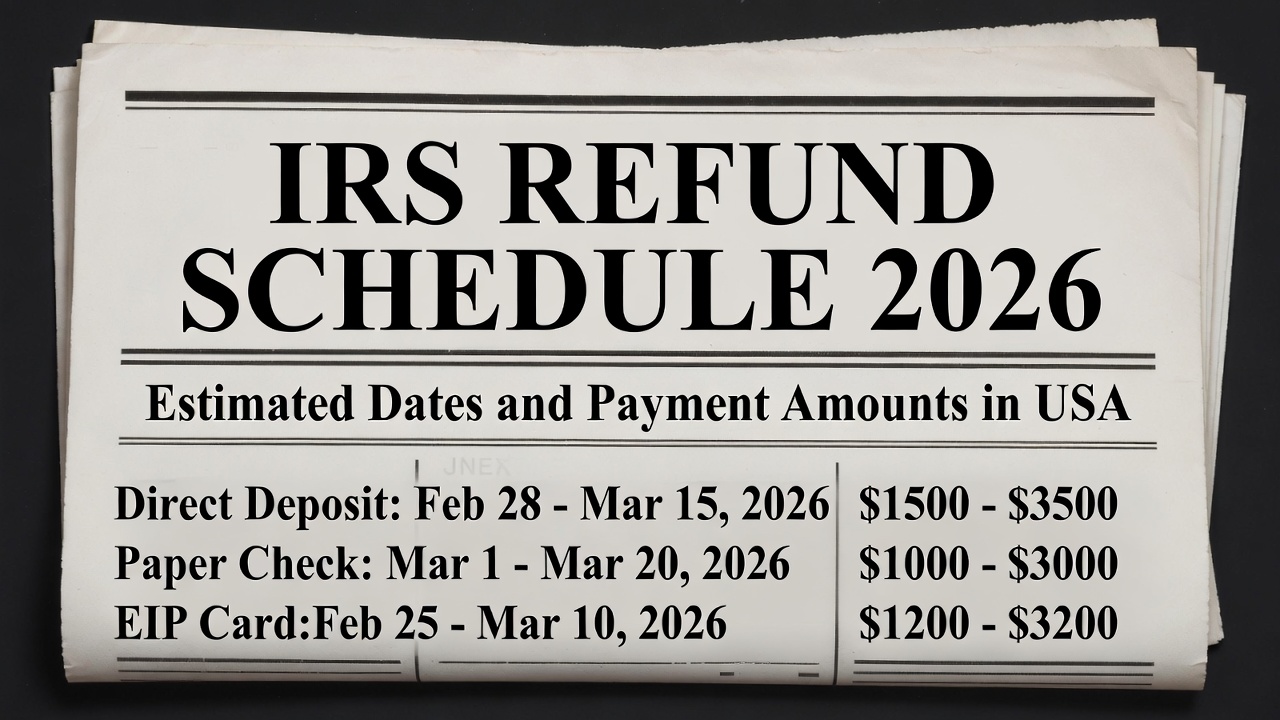

Refund Processing During February

The IRS usually begins accepting federal returns in the last week of January. Once a return is officially accepted, electronic filers who select direct deposit often receive their refunds within 10 to 21 days, assuming there are no errors or review issues. Paper returns take longer because they require manual processing and mailing.

How to Verify Your Refund Status

Taxpayers can check their refund progress through the official IRS online tracking tool. This system shows when a return is received, approved, and sent. Relying on official sources is the best way to avoid misinformation.

Conclusion

Also Read:

IRS Confirms February Refund Date

IRS Confirms February Refund Date

There is no confirmed $2,000 direct deposit for all Americans in February 2026. Any refund amount depends entirely on individual tax details and eligibility.

Disclaimer: This article is for informational purposes only and does not provide tax, legal, or financial advice. Refund amounts and timelines depend on individual circumstances and official IRS procedures. For accurate information, consult IRS.gov or a qualified tax professional.