As the 2026 tax season draws near, many Americans are paying close attention to when their federal tax refunds may arrive. For countless households, a refund is not luxury spending money. It often serves as a financial safety net used to pay rent, manage medical bills, reduce credit card balances, or rebuild savings after a challenging year. Having a clear idea of how the IRS refund timeline works can help families plan with confidence instead of uncertainty.

When the IRS Will Begin Processing Returns

Tax refunds issued in 2026 are based on income earned during the 2025 tax year. The Internal Revenue Service is expected to begin accepting and processing returns in late January 2026. Although some tax software platforms allow people to prepare their returns earlier, the IRS does not start reviewing them until the official opening date. Filing early may place your return near the front of the processing line, but the timeline officially begins only after the return is accepted into the system.

How Long Refunds Usually Take

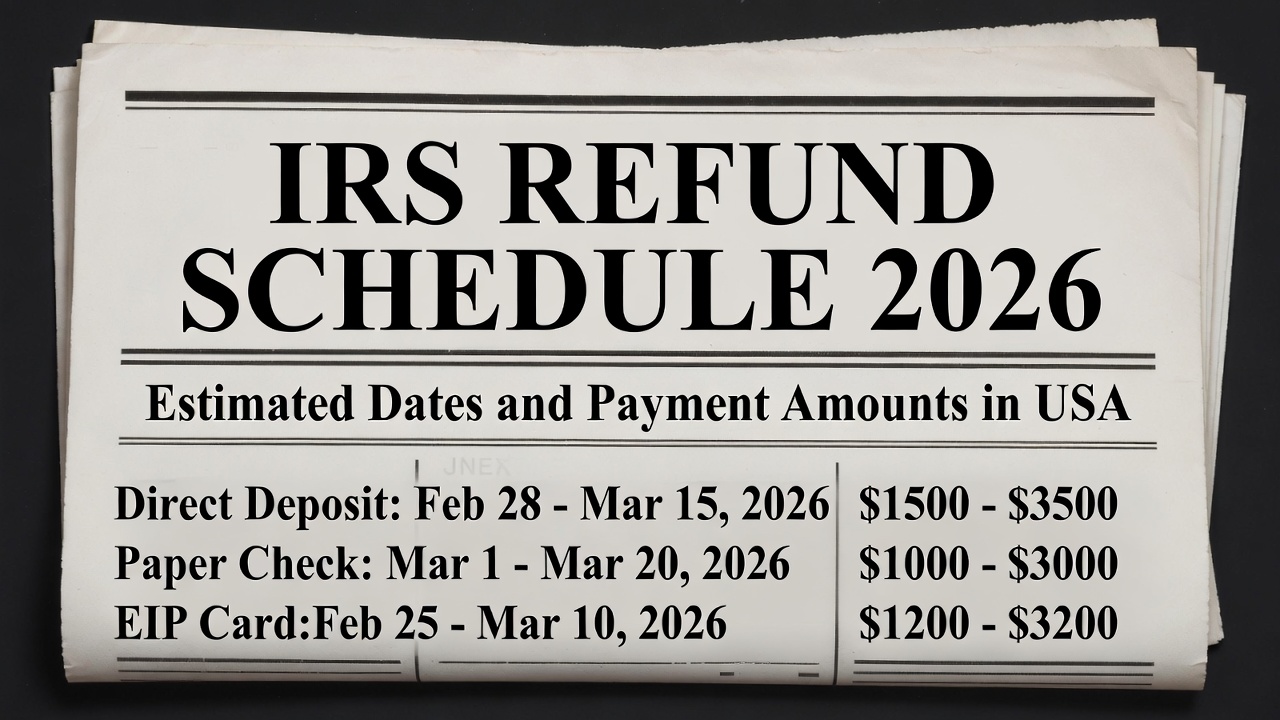

For most taxpayers who file electronically and choose direct deposit, refunds are typically issued within about 21 days. In straightforward cases, some refunds may arrive in as little as 10 to 14 days. However, timing depends on accuracy and whether the return requires further review. Paper-filed returns take significantly longer because they must be processed manually. If a paper check is requested instead of direct deposit, mailing time adds additional delay.

Refund Delays for Certain Tax Credits

Some refunds are held by law, regardless of how early a return is filed. Returns claiming the Earned Income Tax Credit or the Additional Child Tax Credit cannot be released until mid-February. For the 2026 season, those refunds are expected to begin arriving around February 18. This delay is intended to prevent fraud and applies to all eligible filers.

What Affects Your Refund Amount

Refund amounts vary widely. Income level, tax withholding, family size, and eligibility for credits all influence the final figure. Major life events such as starting a new job, having a child, or adjusting retirement contributions can change the outcome. Some individuals may notice smaller refunds if temporary tax benefits from previous years are no longer available.

Tracking and Avoiding Delays

Errors are one of the main reasons refunds are delayed. Incorrect Social Security numbers, wrong bank account details, missing income forms, or mismatched information can trigger additional review. Carefully reviewing your return before submitting it greatly improves processing speed. Taxpayers can monitor refund progress using the official IRS tracking tool or mobile app, which provides daily updates once the return is accepted.

Planning Ahead

Also Read:

IRS Today Announced $2,000 Direct Deposit for All in February 2026, Payment Schedule and Eligibility

IRS Today Announced $2,000 Direct Deposit for All in February 2026, Payment Schedule and Eligibility

Understanding how the 2026 refund schedule works allows taxpayers to prepare calmly. Filing electronically, choosing direct deposit, and ensuring accuracy remain the most effective ways to receive funds quickly and smoothly.

Disclaimer: This article is for informational purposes only and does not provide tax, legal, or financial advice. IRS policies, refund timelines, and eligibility rules may change. Refund timing and amounts depend on individual tax situations. For official guidance, consult the IRS website or a qualified tax professional.

Also Read:

IRS Confirms February Refund Date

IRS Confirms February Refund Date