As the 2026 tax season gets underway, millions of Americans are preparing to submit their federal income tax returns for the 2025 tax year. For many households, a tax refund is not simply extra money. It often helps cover essential expenses such as rent, groceries, school costs, medical bills, or insurance payments. Knowing how the refund system works and when payments may arrive can make financial planning easier and reduce anxiety during tax season.

When the IRS Starts Accepting Returns

The Internal Revenue Service is expected to begin officially accepting and processing 2025 tax returns in the final week of January 2026. While tax preparation software may allow individuals to complete their returns earlier, the IRS does not begin reviewing submissions until the official opening date. Sending a return before processing begins does not result in faster payment.

The deadline to file a federal return for the 2025 tax year is April 15, 2026. Taxpayers who need additional time may request an extension, but it is important to remember that an extension only applies to filing paperwork. Any taxes owed must still be paid by the April deadline. Waiting until the last minute to file can increase the chance of delays, as IRS systems become busier closer to the due date.

How Refund Processing Works

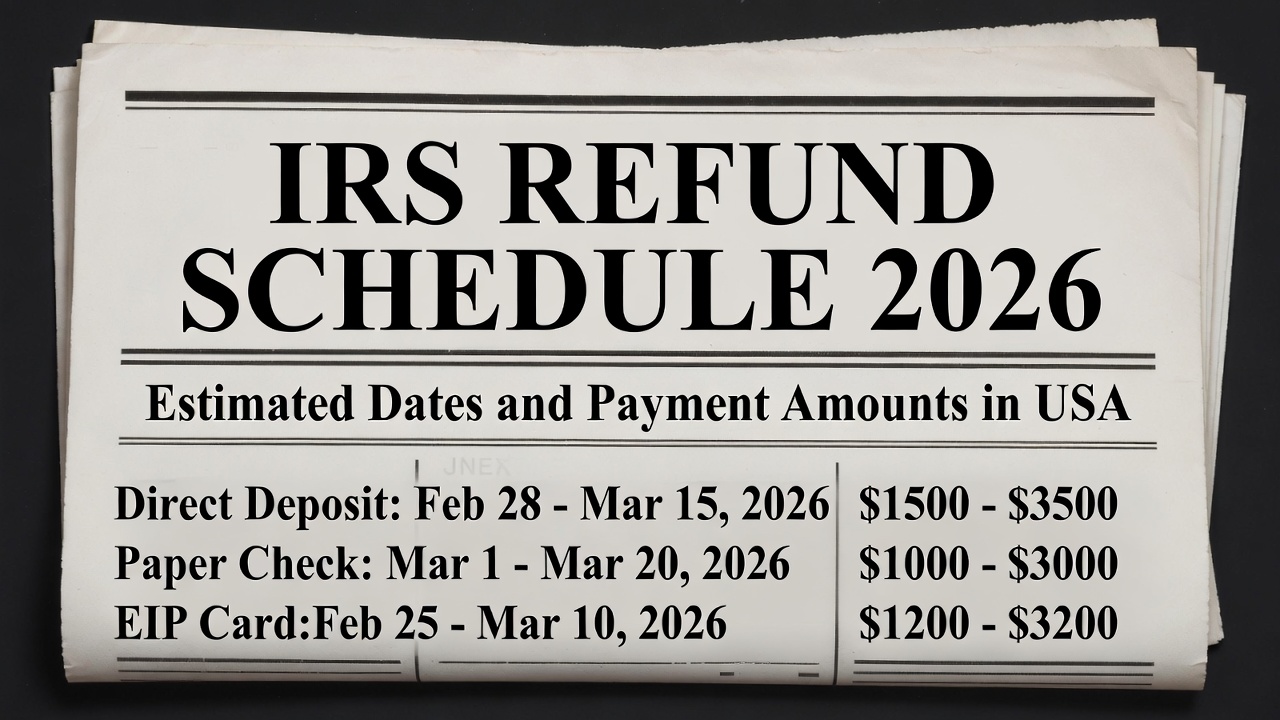

Refund timing varies from person to person because every return is reviewed individually. The IRS does not publish fixed payment dates. Processing speed depends on several factors, including the filing method, the accuracy of the information provided, and whether the return requires further verification.

यह भी पढ़े:

IRS Today Announced $2,000 Direct Deposit for All in February 2026, Payment Schedule and Eligibility

IRS Today Announced $2,000 Direct Deposit for All in February 2026, Payment Schedule and Eligibility

Electronic filing combined with direct deposit is generally the quickest method. Many straightforward and error-free returns are processed within about three weeks. In contrast, paper returns and mailed refund checks take longer due to manual handling, which can add several additional weeks.

Common Reasons for Delays

Certain tax returns require extra review. Returns claiming refundable credits may go through additional fraud screening. Errors such as incorrect bank account numbers, missing income documents, or mismatched personal information can also slow processing. When issues are identified, returns may be placed under manual review, extending the timeline.

यह भी पढ़े:

IRS Confirms February Refund Date

IRS Confirms February Refund Date

Tracking Your Refund

Taxpayers can check the status of their refund using the official IRS “Where’s My Refund?” tool. This online system shows whether a return has been received, approved, or sent for payment. Once a refund is issued, banks may take one or two business days to make funds available.

Planning with Confidence

Filing early can help avoid backlogs, but accuracy is more important than speed. Carefully reviewing all information before submitting a return reduces the risk of delays. Understanding that refund estimates are not guarantees allows taxpayers to manage expectations and plan responsibly.

Disclaimer: This article is for informational purposes only and does not provide legal, financial, or tax advice. Refund amounts, processing times, and IRS policies may vary based on individual circumstances. For official guidance, consult IRS resources or a qualified tax professional.

यह भी पढ़े:

IRS Tax Refund 2026 Schedule

IRS Tax Refund 2026 Schedule